A Guide to Understanding Medicare in Personal Injury Claims

Our NC Medicare Attorneys Explain the Payment Process

Medicare is a federal health insurance program for people who are 65 or older, and people with End-Stage Renal Disease. Additionally, if you qualify for Social Security Disability (SSD) benefits due to a health condition or an injury that prevents you from working, then you automatically qualify for Medicare coverage as well, regardless of your age. In this case, you must wait two years after you become eligible for SSD for your Medicare coverage to begin. Many people use Medicare as their sole health insurance coverage. However, you may also use it as a companion plan or as a backup to a health insurance policy that you have through your employer, spouse, former employer or union. If you use Medicare to pay your medical bills after an accident, then an attorney can assist you in repaying these costs after a settlement or verdict.

Our North Carolina personal injury lawyers have been handling Medicare issues for over 30 years as part of our representation of injured clients. Our Social Security disability attorneys assist clients in initial Medicare enrollment, while our personal injury lawyers frequently handle conditional payment reimbursement issues. If you received a notice that you must refund Medicare certain payments or need assistance with disability benefits and healthcare, then we can help. Contact our attorneys today to find out how we can help you afford your healthcare.

What Are the Different Medicare Plans?

The Medicare program includes several plans or “parts.” These are:

- Medicare Part A coverage includes hospital bills, nursing facilities, hospice and home healthcare. This is essentially hospital or emergency coverage.

- Medicare Part B can help you pay for doctor visits and medical services. This includes routine services and screenings for heart disease, cancer and diabetes.

- Medicare Part C, also known as Medicare Advantage plans, consists of Medicare- approved plans offered by private insurance companies. Usually, Part C covers doctor’s visits and hospital bills, but it may also cover the cost of prescription drugs, too.

- Medicare Part D plans are Medicare-approved private plans that apply only to medications. These plans help people with Medicare Parts A and B pay for prescription drugs.

Even if you have multiple Medicare plans, this insurance will not cover all healthcare costs. Medicare does not apply to services such as routine dental and vision care. Also, unless you have additional insurance or qualify for low income assistance, even with Medicare, you will pay some premiums, deductibles and copays.

Can I Use Medicare to Pay My Medical Bills If I Filed a Personal Injury Claim?

Medicare generally does not pay for items and services to the extent that payment has been made, or may reasonably be expected to be made, through a liability, no fault or workers’ compensation insurance. However, Medicare may make a conditional payment. This protects you from having to use your own money to pay the bill. The payment is “conditional” because you must pay this amount back to Medicare when and if you receive a settlement, judgment, award or other payment.

For example, you may need emergency treatment for injuries you receive in a car accident. However, the other driver’s liability insurance may not pay your hospital bill because it disputes fault for the wreck. Instead, Medicare pays your hospital bill while you file a claim. Later, you may reach a settlement with the insurance company. When this happens, you must use a portion of your settlement money to reimburse Medicare for the conditional payments it made.

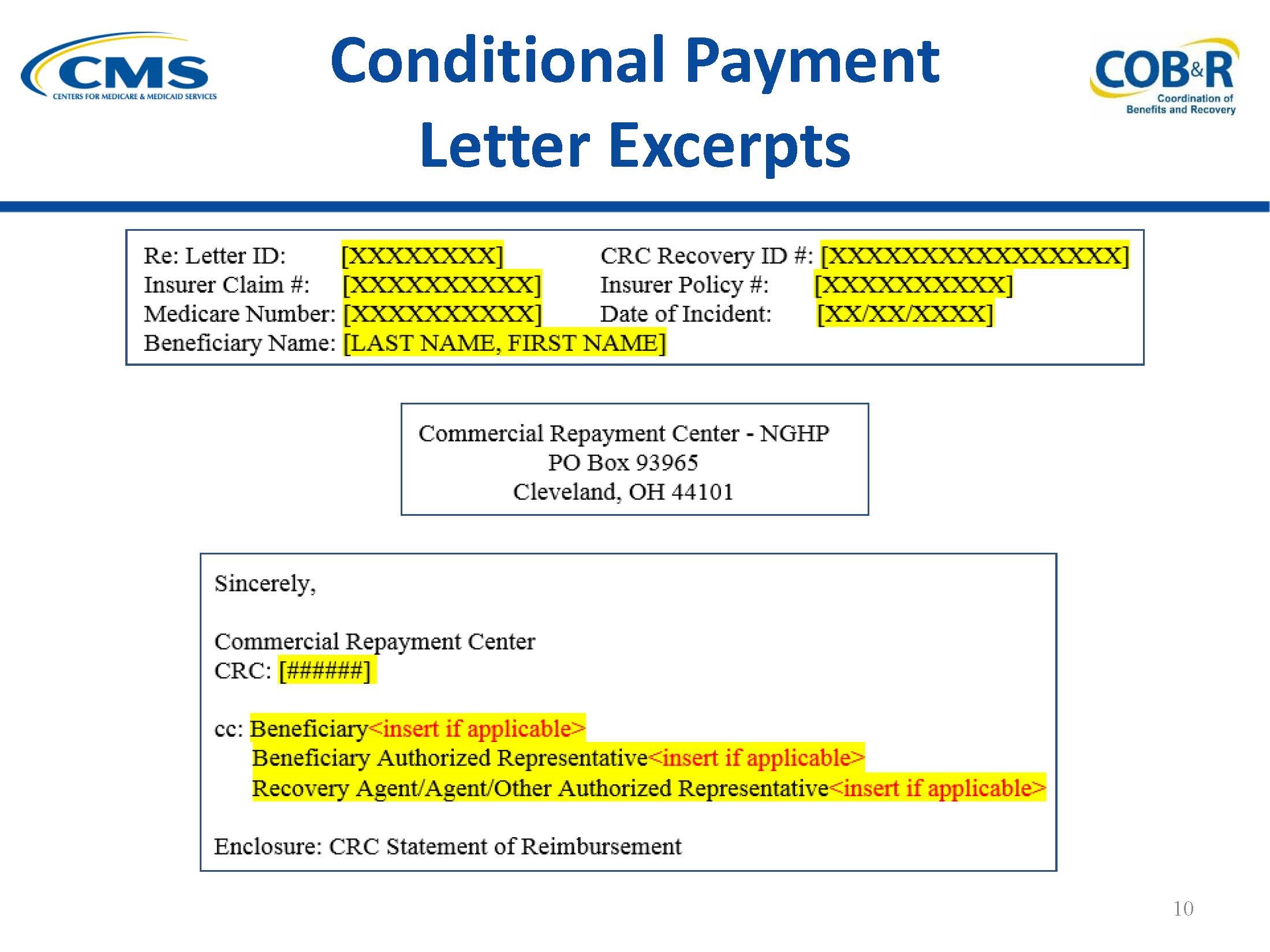

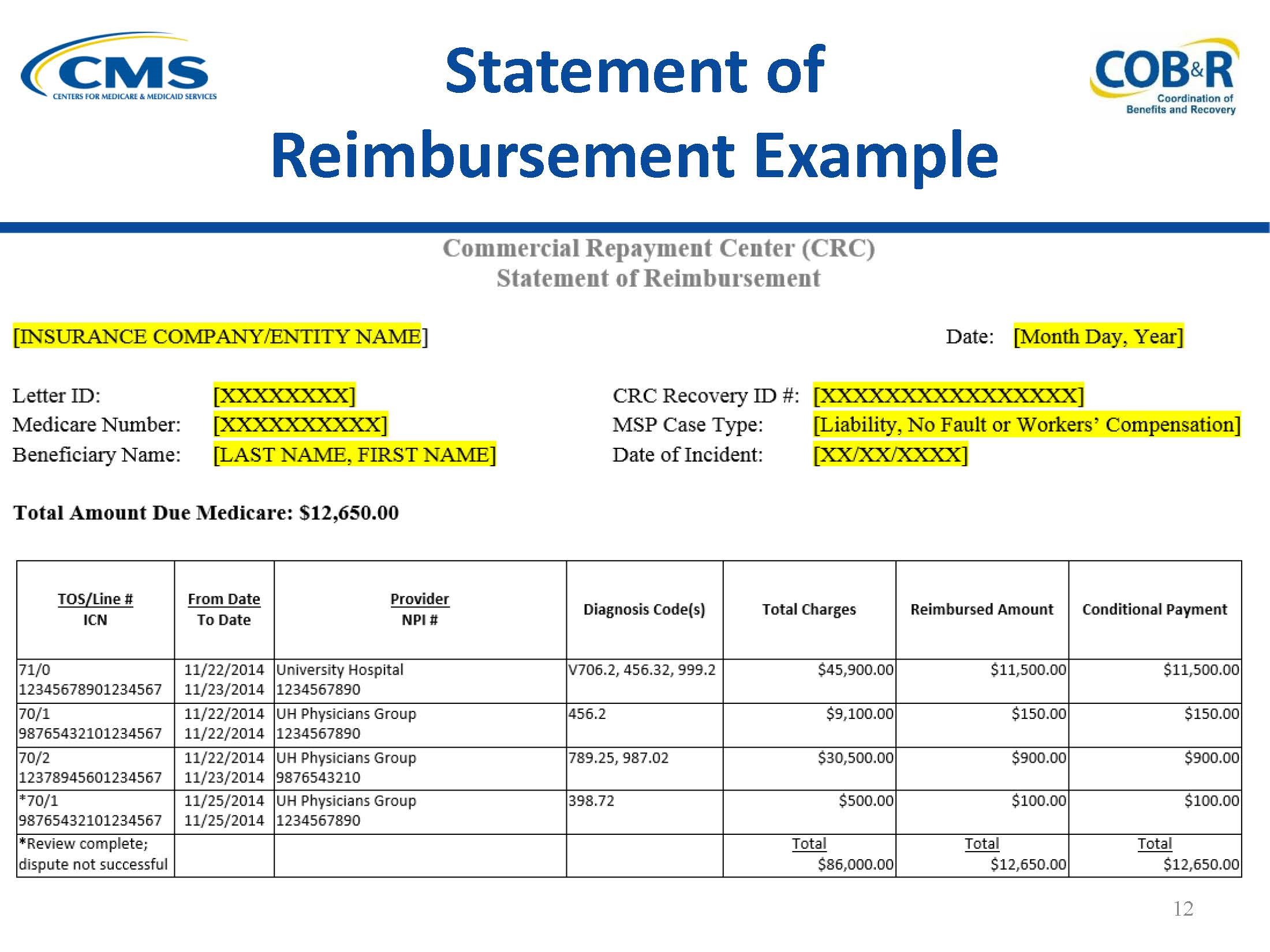

The Benefits Coordination and Recovery Center (BCRC) is responsible for making sure that you repay Medicare for any conditional payments you receive. Our attorneys work with the BCRC on every case involving a client who has Medicare coverage. Generally, the BCRC will send a conditional payment with all detailed claim information to the beneficiary. This letter will not include the final amount as Medicare may continue making conditional payments while your claim is pending.

The BCRC will send out a formal recovery demand letter once there is a settlement, judgment, award or other payment. As Medicare attorneys, we always request an “interim conditional payment letter” which lists all related claims paid to date. We thoroughly review this list of payments for accuracy.

How Can Medicare Attorneys Help Me?

Although an attorney is not strictly necessary for Medicare enrollment or to handle conditional payments, having legal counsel on your side can save you time and stress. After an injury, the steps and processes our attorneys follow for clients who have Medicare include:

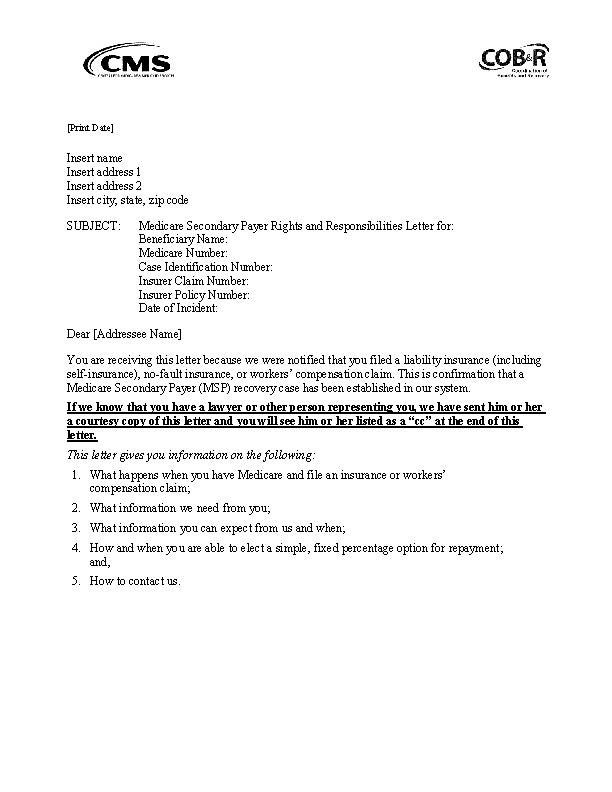

- Rights and Responsibilities Letter. Medicare usually sends the Rights and Responsibilities letter to our office and to you within a few weeks of the first notice.

- Cover Sheet from Medicare. A cover sheet from Medicare will accompany the Rights and Responsibility letter. We save the letter and use the coversheet whenever corresponding with Medicare. There is a bar code on the coversheet that is specific to your case.

- The First Notice to Medicare. We then fax our first notice to Medicare. We will also send a Proof of Representation Letter to Medicare at this time.

- Final Request for a Lien. You must pay the final lien amount (the amount of all conditional payments) to Medicare within 60 days of receipt of settlement to avoid interest. Our Medicare attorneys do not request the final lien until your case settles. When requesting the final lien, we include the total amount of the settlement, the attorney fee amount, amount of any costs and the date the case was settled. Usually, we can negotiate to reduce the amount of Medicare’s final lien. We review the bills submitted by Medicare and we can request the removal of unrelated charges. If Medicare refuses to remove the unrelated charges, then we usually pay the lien to avoid the accrual of interest. We can always appeal the decision of Medicare all the way to a hearing with an administrative law judge, if necessary. Our attorneys have successfully handled several of these appeals for our clients.

Need Medicare Help? Contact Our North Carolina Medicare Attorneys Now

If you or a loved one has suffered an injury in an accident and Medicare paid some of your bills, then contact our personal injury attorneys at Riddle & Brantley. We have offices in Raleigh, Goldsboro, Jacksonville and Kinston. Call (800)525-7111 or contact us online to schedule a free initial consultation.